allowable expenses limited company – allowable expenses for ssi money

Taking advantage of claiming the expense while running a limited company from home will do this job comfortably for you It is vital to remember when calculating the allowable expenses that can be claimed for your limited Company that all the expenses made …

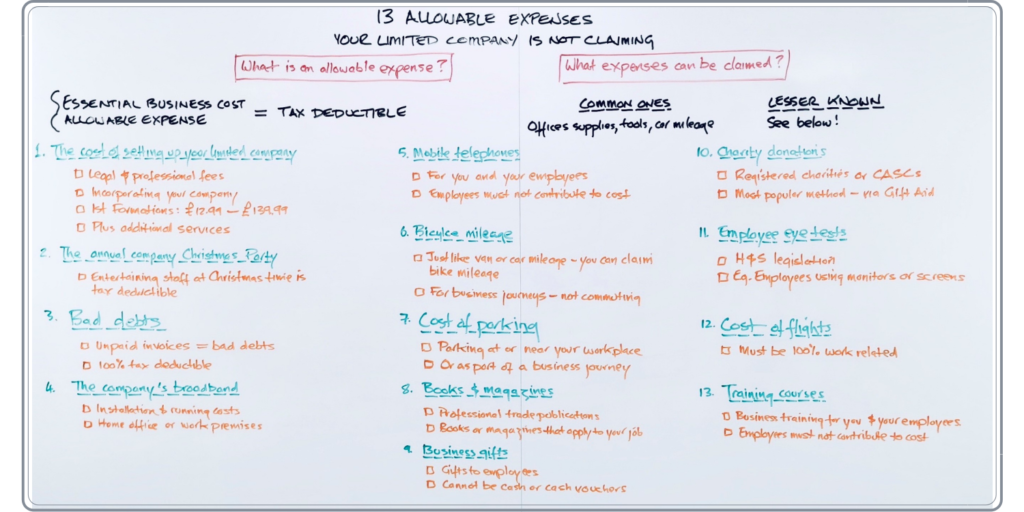

Allowable expenses in a Limited Company

What business expenses can you

· You can claim the cost of your business insurance policies as limited company expenses as long as they’re used strictly for business purposes Business insurances including public liability insurance employers liability professional indemnity insurance and contents insurance are all allowable expenses Advertising marketing and PR expenses

Temps de Lecture Estimé: 10 mins

A guide to allowable expenses for a limited company

Some expenses are not allowed for Corporation Tax for example entertaining clients – add these back to your profits when you prepare your Company Tax Return,

Limited Company Expenses Guide 2020/21 UK Small Business

· Thankfully though almost all of the costs you’ll incur with your staff are allowance expenses for a limited company You can deduct all salary payments and pensions contributions from your profit That also includes the income tax and National Insurance Employee’s Contribution you have to collect from your staff when you pay them,

· Given the current situation with COVID-19 and many of you working from home we’ve updated our limited company expense guide so you can better understand what you can claim for When you’re busy running your business it can be difficult trying to keep track of what limited company expenses you can claim for tax relief, And this could lead

· Understanding the allowable expenses you can claim as a limited company can help you to reduce your Corporation Tax bill You can subtract allowable business expenses from your revenue to calculate your company’s profit and therefore the amount of Corporation Tax you need to pay,

Allowable Expenses for a Limited Company – A Complete Guide

· Mobile phone landline and broadband expenses as a limited company If your landline phone contract is only for business use this is an allowable company expense and you won’t be taxed personally By having a separate phone line for ‘only business’ it shows this is 100% for business

Limited Company Expenses: A Complete Guide

Tax-deductible expenses for limited companies

· The Annual Investment Allowance AIA allows businesses to spend up to £1 million a year on new assets and then deduct that cost from their taxable profits, There is also a 100 per cent first-year allowance that let you claim back tax on an asset in the year you purchase it, What are the disallowable, non-tax-deductible expenses?

Corporation Tax rates and reliefs: Allowances and reliefs

· The equipment you use to do your job can also be an allowable expense for limited company cost In essence this refers to anything that’s necessary for your duties as a director from computers to printers and software You may be able to claim for the cost of furnishing an office as well including chairs and desks Training and Development, If you’re self-employed, you understand the

· Any allowed expenses will reduce your company’s profits, and therefore the amount of Corporation Tax the company has to pay when your accountant submits your annual company tax return, Expenses which have a ‘duality of purpose’, i,e, which have a personal and business element are not generally allowable,

What business expenses can I claim as a Limited Company

· How to claim allowable expenses as a limited company; How to keep track of limited company expenses; Wrapping up; What are allowable expenses? Allowable expenses are business expenses that can be deducted from your income to reduce the amount of Corporation Tax you pay, For example, if your revenue is £40,000 and your allowable expenses are £5,000, you’ll only be taxed on …

Allowable Limited Company Expenses for 2020: Your Guide

allowable expenses limited company

Allowable expenses for a limited company are a very important aspect of any business Nobody wants to pay extra tax than they have to spend which is why making your company as tax effective as possible will help save you a bit of money Note when it comes to finding out what costs you may report for your limited company the guiding principle is that they must be paid completely solely and

What expenses can I claim as a limited company?

What allowable expenses can limited companies claim?

Allowable expenses in a Limited Company, This is a summary about the allowable business expenses and will help you save money by giving you detailed instructions on exactly what you can claim as business expenses – and how to do it, Knowing these data might as well save some of the personal tax you pay, When claiming back expenses, any business expenditure which you paid personally can be …