basic star application form – enhanced star application 2020 2021

· Basic Star Exemption Application Determine the star application to modify the result is this The basic star exemption application star or

STAR School Tax Relief exemption forms

the income qualification for the Basic STAR exemption b The amount shown on line 7 of your 2018 federal Form 1040 minus the amount shown on line 4b is more than $250000 You do not meet the income qualification for the Basic STAR exemption, c If line 4b of your 2018 federal Form 1040 is zero your taxable IRA distributions are zero

How do I apply for Basic STAR? How do I apply for Enhanced

· Fichier PDF

This event is part of the Visual Basic Application model For more information see Overview of the Visual Basic Application Model You can use the Cancel property of the e parameter to control the loading of an application’s startup form When the Cancel property is set to True the startup form does not start, In that case, your code should call an alternate startup code path, You can use

Register for the STAR credit

basic star application form

Application forms are critically important to companies, schools, and nonprofits, JotForm simplifies online application forms, whether you need it for collecting information for loans, job applications, scholarships, or even housing,If you don’t have the proper application template, you could be hindering your ability to get tasks done or collect the information you need,

WindowsFormsApplicationBaseStartup Event Microsoft

STAR exemption program

· If you are voluntarily switching to the STAR credit from the STAR exemption: follow the instructions below to register for the STAR credit and select the option Make the Switch on the first page of the registration If you received a letter that you must update your registration Form RP-425-RDM:

New York State School Tax Relief Program STAR

The Basic STAR exemption reduces the school tax liability for qualifying homeowners by exempting a portion of the value of their home from the school tax To qualify the home must be: • and submit it to the assessor along with this form To determine owner-occupied and • the homeowners’ primary residence The combined 2020 income of the owners and spouses who reside on the property

Explorez davantage

| New York State School Tax Relief Program STAR | www1nyc,gov |

| STAR exemption program – Government of New York | www,tax,ny,gov |

| STAR eligibility – Government of New York | www,tax,ny,gov |

| Register for the STAR credit | www,tax,ny,gov |

Recommandé pour vous en fonction de ce qui est populaire • Avis

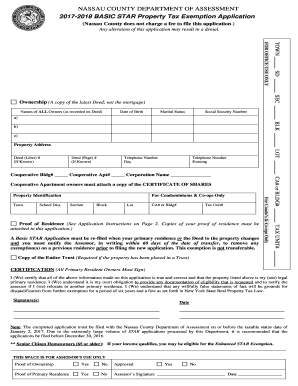

Form RP-425-B:7/19:Application for Basic STAR Exemption

· Fichier PDF

Form RP-425-B:8/21 Application for Basic STAR Exemption

· Fichier PDF

STAR can be a powerful tool to show the selection panel how well you meet the selection criteria competencies or capabilities, but it’s up to you to use it well in your job application, Find a

· For Basic, submit Form RP-425-B, Application for Basic STAR Exemption to your assessor,* For Enhanced, submit Form RP-425-E, Application for Enhanced STAR Exemption to your assessor,* To upgrade to the Enhanced STAR exemption See Eligibility to learn if you qualify for the Enhanced benefit,

Using ST,A,R effectively in your job application and

· Fichier PDF

Apply with the NYC Department of Finance or by completing the “STAR to ESTAR” application If you had a Basic STAR exemption on your property since 2015 or before and have since lost it you can apply to restore your STAR exemption by completing the STAR Benefit Restoration application, Download the form Apply by phone hide this list show this list If your income is greater than $250,000

· Application for School Tax Relief STAR Exemption This form has been replaced by Forms RP-425-B and RP-425-E, NYC-STAR Instructions on form: Homeowner Tax Benefit Application for STAR Exemption New York City Finance Nassau County: Not applicable: Property Tax Exemption Forms excluding Glen Cove RP-425-B Fill-in Instructions on form

Form RP-425-E Application for Enhanced STAR Exemption for

· Fichier PDF

Basic STAR works by exempting the first $30000 of the full value of a home from school taxes Enhanced STAR The initial application form RP-467 is also available in large print How is STAR administered where property is in a trust? The ownership of property is split when it is placed in trust: the trustee is the legal owner; the beneficiary is the beneficial owner However for STAR

Taille du fichier : 111KB

Basic Star Exemption Application

About Basic STAR and Enhanced STAR The School Tax Relief STAR and Enhanced School Tax Relief E-STAR benefits offer property tax relief to eligible New York State homeowners Who Can Apply Homeowners not currently receiving the STAR exemption who meet the program’s eligibility requirements may apply for the STAR tax credit with the New York State Department of Taxation and …

School Tax Relief Program STAR – ACCESS NYC

Form RP-425-Wkst Income for STAR Purposes Worksheet to the assessor If you answered No to either question 2 or 3 then you do not qualify for the Enhanced STAR exemption but may continue to receive Basic STAR 4 Do you or your spouse own another property that is either receiving a STAR exemption in New

Application Forms – Form Templates