is pension contribution taxed – is pension considered earned income

· · However, if you contributed to your pension with after-tax funds, you don’t have to pay taxes on any part of the pension that’s considered to be a return of these contributions …

· Your pension contributions are tax free up to a certain amount, known as the “allowance”, There’s both a lifetime and an annual allowance to consider, There’s both a lifetime and an annual allowance to consider,

· The good news is that some of your pension is tax free If you have a defined contribution pension the most common kind you can take 25 per cent of your pension free of income tax

Workplace pensions: Managing your pension

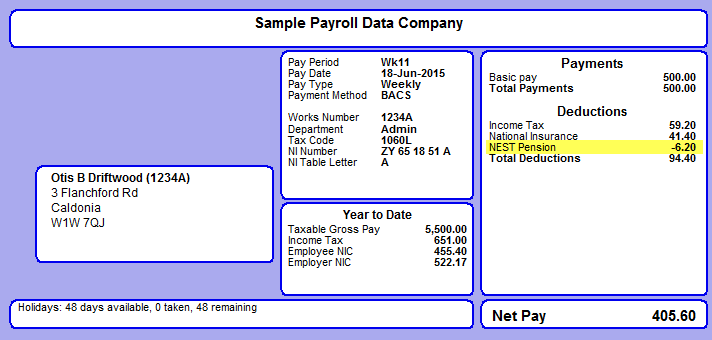

Your employer takes your pension contribution after taking tax and National Insurance from your pay, However much you earn, your pension provider then adds tax relief to your pension pot at the

Workplace pensions: What you your employer and the

Tax on your private pension contributions: Tax relief

· Tax relief for pension contributions, You can get Income Tax IT relief against earnings from your employment for your pension contributions including Additional Voluntary Contributions AVCs, Pension contributions to these types of pension plans: Occupational pension schemes; Personal Retirement Savings Accounts PRSAs

Tax relief for pension contributions

A pension worth up to £30,000 that includes a defined benefit pension If you have £30,000 or less in all of your private pensions, you can usually take everything you have in your defined benefit

Is Pension Considered Income and Taxable at the Federal Level?

· · Depending on how contributions were made and by whom e,g,, by your employer or by you, your pension may be fully taxed, partially taxed, or not taxed at all, Also, the type of pension or retirement account matters: employer-funded pensions are treated somewhat differently than IRA and 401k accounts,

Only occupational, stakeholder and personal pensions where tax relief has been granted against contributions or the lump sum is tax free are eligible to be taxed as pension income, Unregistered pension schemes that grant no tax relief in your home country are taxed as investment income,

Tax relief is paid on your pension contributions at the highest rate of income tax you pay,

Tax on your private pension contributions

The government will usually add money to your workplace pension in the form of tax relief if both of the following apply: you pay Income Tax you pay into a personal pension or workplace pension

is pension contribution taxed

Your private pension contributions are tax-free up to certain limits, This applies to most private pension schemes, for example: workplace pensions; personal and stakeholder pensions

OverviewYour private pension contributions are tax-free up to certain limits, This applies to most private pension schemes, for example: workplace pensionsTax reliefYou can get tax relief on private pension contributions worth up to 100% of your annual earnings, You get the tax relief automatically if your: empAnnual allowanceYour annual allowance is the most you can save in your pension pots in a tax year 6 April to 5 April before you have to pay tax, You’ll only payLifetime allowanceYou usually pay tax if your pension pots are worth more than the lifetime allowance, This is currently £1,073,100, You might be able to protect you

How much tax will I pay on my pension and how can I avoid it?

Tax when you get a pension: What’s tax-free

French Income Tax

· Is pension taxable? Yes pensions are generally subject to federal tax However depending on the nature of the pension contribution, a pension may be fully taxable or only partially taxable,

How Will Your Retirement Benefits Be Taxed?

Tax relief on pension contributions explained

Are pension contributions taxable?

employer takes workplace pension contributions out of your pay before deducting Income Tax rate of Income Tax is 20% – your pension provider will claim it as tax relief and add it to your pension

Explorez davantage

| How to Calculate Personal Pension Tax Relief | www,onlinemoneyadvisor,co,uk |

| Claiming tax relief for personal pensions FAQ – Aegon UK | www,aegon,co,uk |

| Pension Tax Relief at 40% — MoneySavingExpert Forum | forums,moneysavingexpert,com |

| Tax when you get a pension: What’s tax-free – GOV,UK | www,gov,uk |

| Claiming Tax Relief On Pension Contributions , OpenMoney | www,open-money,co,uk |

Recommandé pour vous en fonction de ce qui est populaire • Avis

Are pension benefits taxable?